Simplifying the off-ramp for entrepreneurs when it is time to close shop: In the light of Sec 271(a) of the Companies Act vs Section 10 of the IBC 2016

Adv. K. Senguttuvan

Adv. Sneha Tiwari

Adv. Himani Gill

Advocates of SAPAA Law Firm

Introduction

A significant decision, closing a business entails ending all operations and dissolving the Corporate Legal Entity. Paying off outstanding debts and obligations, such as leases, loans, and vendor and supplier payments, is a necessary step in closing a business.

There are several reasons as to why a company decides to wind up, although winding up a business can be a complex, stressful process and can also fail. It can be carried out properly and smoothly with careful planning, open communication and adherence to regulatory regulations.

The Section 271(a) of the Companies Act, 2013 provides for winding up by way of member’s special resolution, it is further governed by the other provisions of the Companies Act, 2013 and newly introduced Companies (Winding Up) Rules, 2020 whereas Section 10 of the IBC, 2016 lays the ground for initiation of corporate insolvency resolution process[1] by the Company itself in the event of a default.

The author, through this piece of work, intends to help the business owners to choose the right arena for smooth closing of their business.

Under Section 271(a) of the Companies Act 2013

The clause (a) U/s 271 of the Companies Act, 2013 fulfils the will of the shareholders to dilute a company, completely, at the events where they conclude that they will not be able to run the business for any reasons which can be justified before the Hon’ble NCLT.

a. Continuous loss and non-revival state of business

In the matter of Marshal Multitrade Private Limited[2], where the company was engaged in the business of Trading of edible oil seeds particularly soya. The company suffered continuous losses. The Hon’ble NCLT Mumbai allowed the Petition U/s 272 of the CA2013. The same by Hon’ble Tribunal in Glorishine Impex Private Limited[3] .

Interestingly, in the matter of Vishal Soyamul Private Limited[4], the Hon’ble NCLT allowed for winding up of the Company even though Income Tax department objected to the winding up stating that total demand of Rs. 15,196/- was outstanding for payment and re-assessment proceedings U/s 148 in relation to A.Y. 2017-18 was in progress.

b. Non-functioning of business

Hon’ble NCLT of Chennai, in a matter[5] where the financial statement of the Company clearly reflected that no business has been carried out for five years and the business owner had no intention to carry on the business further, ordered for winding up of the Company.

c. No scope of revival of business

Furthermore, in another matter[6] where the functioning of the business was hit by pandemic COVID-19 and the company suffered huge loss and being surrounded with debts having no scope of revival of business, approached the Hon’ble NCLT U/s 272 of the Act, the Hon’ble NCLT after consideration of the financial position of the Company along with the fact that there existed no objection from any creditor, ordered for winding up.

The steps under this provision of law

The steps for filing the application under this provision of law is

I. Application before the Hon’ble NCLT- along with the application the recent statement of affairs of the company

- Consideration of the application by the Hon’ble NCLT.

- Upon the direction of the NCLT intimation of the application to the Statutory authorities, RoC[7] and other creditors.

- Filing of Report by the RoC before the Hon’ble NCLT

- Objections by the Creditors, if any.

- Order of the NCLT, admitting the case and appointing the liquidator.

II. Liquidation

- The Liquidator will be appointed by the NCLT only.

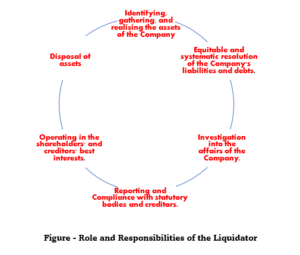

The Steps to be performed by the Liquidator-.

a. Take the control and custody of Company’s Properties.

b. Public Announcement in the newspaper in local and English newspaper

c. Compliance with the Tax Laws/ statutory filings, if the company is a functioning company

d. Official Liquidator to make Inventory

e. Submission of Report by Company Liquidator- Preliminary

f. Directions of Tribunal on Report of Company Liquidator

g. Communication to the stakeholder and creditors.

h. Settlement of List of Contributories and Application of Assets

i. Distribution of Property of Company

j. Final Report to the tribunal along with application for dissolution.

III. Dissolution

a. Application to Hon’ble NCLT.

b. Submission of order to RoC

c. Surrendering the Incorporation Certificate of the Company before RoC.

U/s 10 of Insolvency and Bankruptcy Code, 2016

The Insolvency and Bankruptcy code, 2016 (hereinafter referred to as IBC, 2016) is a beneficial legislation enacted for resolution of insolvency of the Corporate Person. The ultimate objection of the Code is to either resolve the issue by way of Resolution plan or to dissolve the Corporate Debtor. U/s 10 of the IBC the Corporate Person can file an application for initiation of its own Corporate Insolvency Resolution Process (“CIRP”) on the grounds of default.

The term default is defined U/s 2(12) of IBC as, “non-payment of debt when whole or any part or instalment of the amount of debt has become due and payable and is not paid by the debtor or the corporate debtor, as the case may be;” . Thus, the default should explicitly relate to non-payment of debt owed to Financial Creditor and Operational Creditor.

Judicial analysis as to how the Courts perceive of this section

a. Inability to pay inter-corporate loan

The Company M/s. Phonic Online Private Limited[8], primarily involved in the business of trading and distribution directly or indirectly of telecommunication devices such as smartphone filed an application U/s 10 IBC, 2016 before the Hon’ble NCLT, Delhi, for its inability to pay inter-corporate loan, owing to the worldwide impact of Covid-19, the business of the Corporate Applicant was adversely impacted. The Corporate Applicant together with the supplier held several discussions to function and avail the facilities of a credit-based supply chain module which was eventually not agreed by the suppliers, but nothing bearded the fruit. Eventually the Corporate applicant succeeded, with the application.

b. Proof of default and Completeness of the Application, no bar U/s 11 IBC is the main criterion

In the matter of M/s. Unigreen Global Private Limited[9] the Hon’ble NCLT rejected the application U/s 10 and imposed cost on the ground that they have suppressed the Corporate Applicant is a party to the matter involving the property in which the other party i.e. Financial Creditor had interest. Aggrieved by the said order appeal was preferred.

The Hon’ble NCLAT reversed the order of NCLT and clarified that if there is proof of default, completeness of the application, and no bars U/s 11 of the IBC, the AA[10] should approve the CD’s request for starting a CIRP. Any irrelevant details or information outside the requirements of the IBC or its attached forms should not prevent the Adjudicating Authority (i.e., NCLT) from accepting the application.

In the matter of Pondicherry Extraction Industries Pvt. Ltd.[11], here in the Corporate Applicant was the Guarantor to the Financial Creditor, however the corporate applicant has failed to mention details of the collateral securities given by the actual borrower, on this ground the NCLT rejected the application, the Corporate Applicant preferred appeal against the said order.

The Hon’ble NCLAT mentioned that “section 10 of IB Code does not empower the Adjudicating Authority to go beyond the records as prescribed U/s 10 and the information as required to be submitted in Form 6 of Adjudicating Authority Rules”, thus remitted the matter back to the Hon’ble NCLT Chennai.

c. When the company has no assets

Interestingly, in a matter CP (IB) No.96/BB/2020[12], the petition of the corporate applicant was admitted and the CIRP was supposed to be initiated by the Interim Resolution Professional, however as there existed no asset with the Corporate Applicant, the IRP preferred an interim application[13] for early dissolution and the same was allowed by the NCLT, Bengaluru invoking its inherent powers.

Instances where the court has rejected the application

a. When the preferred Application is not for the resolution of the corporate applicant

In a matter the corporate applicant Jayam Vyapaar Pvt. Ltd[14] was carrying the liability of Rs 2,86 crore as Income Tax demand and the same was appealed; the demand arose due to money laundering which empowers to recover from the directors. The NCLT held that, the IBC is for resolution and when resolution is not workable for valid reasons, then liquidation; AA is not the recovery tribunal to recover or give relief. The NCLT invoked section 65, as the intent of the applicant was fraudulent and malicious and imposed cost of Rs. One lakh on the corporate applicant.

b. Application to thwart other proceedings

The application of the corporate applicant Dhruvi Foods & Beverages Limited[15], was dismissed by the Hon’ble NCLT Mumbai bench on the ground that their existed absence of the exact date of default in relation to debt due to other Operational Creditors or Statutory Authorities and the default occurred under the time limit mentioned U/s 10A, and hence the bench was of the view that, the petition has been filed simultaneously to thwart the proceedings under SARFAESI Act, thus dismissed.

c. Ulterior motive to take the benefit of Moratorium

In AGROHA PAPER INDUSTRIES PVT. LTD[16], the Corporate Applicant/ Borrower on one hand was trying to make efforts for OTS with the Financial Creditor and on the other hand filed the Section 10 application before the Hon’ble NCLT bench of Allahabad, the Tribunal held that “the applicant seems to not have come with clean hands in as much as, it has been making all out efforts to stall the process in one way or the other, by abuse of process of law”, and due to lack of bonafides the Court dismissed the Petition.

d. On the grounds of limitation

The Hon’ble NCLT Kolkata in the matter of Laxmi Cores Manufacturing Private Limited[17] and Vrinda Ispat Private Limited[18] rejected the application on the ground that “date of default” of has hit by the period of limitation.

The steps under this provision of law

1. Application before the NCLT –

- Form 6 along with the following documents –a. Balance sheet and books of accounts of the Company evidencing default.

a. List of the Financial and Operational Creditor.

b. Details of security furnished if any.

c. Details of any pending proceedings and

d. Details of guarantee furnished.

e. Consent of the Interim Resolution Professional

2. Corporate Insolvency Resolution Process –

- the major step under the IBC , 2016 is the Resolution Process.

- Under this step the IRP proposed by the Corporate Applicant, takes the Control over the Company.

- Opening of a separate bank account by the IRP.

- Filing of statutory returns.

- Intimation to statutory authority about his appointment.

- Intimation to the Creditors to file their claims.

- Constitution of CoC

- Convening of meeting with the CoC.

- Obtaining the consent of CoC, to continue further as Resolution Professional.

- Filing of progress report with the Tribunal every three months.

- Preparing list of inventories.

- Publication for submission of Resolution Plan.

- Considering of Resolution Plan with the CoC

- Submitting the outcome of the Resolution Plan discussion to NCLT.

In the event of success of the Resolution plan – intimation to the bench and carrying out the further formalities of sale of the Company “as going concern.” Sale of a Company as a ‘Going Concern means sale of both assets and liabilities, it is stated on ‘as is where is basis’.[19]

In the event of failure – application for liquidation.

3. Liquidation

- The Resolution professional can give their consent to be the liquidator and the same should be accepted by the CoC.

- In the event of non-acceptance by the CoC, the Liquidator shall be appointed by the Court.

- Progress report to the Tribunal.

- Consolidation of the liquidation estate.

- Selling the assets of the Company.

- Considering the Claim of the Creditors.

- Settling the debts of the Company as per the waterfall mechanism.

- Final report to the Tribunal

- Application for dissolution.

4. Dissolution

- Submission of order with the RoC

- Surrender of the Incorporation Certificate.

- Filing of the Compliance Report with the Tribunal.

The actual point of difference

The actual question pertaining to differences which arise are, in terms of the Judicial intervention under both the provisions of law, after the application is admitted –

Judicial intervention typically refers to the judicial interference in any matter. Judicial discretion or intervention under any matter determines the longevity of the process of adjudication in any case. When the decision-making authority is only the judiciary there exists no chaos in the functioning of the process. But if the judiciary is involved along with the decision-making process of the Shareholder, the process gets even lengthier.

Influence of creditor, where there exists no asset

Typically, under the 271(a) provision of legislation, the Court has the authority to appoint the liquidator, issue directions about the liquidator’s fees, and review the liquidator’s report.

And, under Rule 88 of the Company Winding Up Rules, 2020, if the Company has no assets, the Court has sole authority to provide directives regarding the liquidation procedure. The creditors have no influence over the liquidator’s fees or appointment, and their decision is not required for the appointment or removal of the liquidator.

Whereas if no assets situation arises U/s 10 application, then the interim resolution professional must initiate the meeting with the Committee of Creditors, get the approval for dissolution and then take the efforts to file an application and plan the dissolution, present the same before the NCLT and get the approval.

Liberty to seek judicial intervention

However, U/s 10 of the IBC, creditors, insolvency professionals, and the party proposing the resolution plan may seek judicial intervention at any point. At the same time, the creditor’s consent is necessary at every point, from determining the number of meetings to understanding the resolution plan and approving it. In this case, the judiciary and the people’s decision-making process must work together, which is a time-consuming procedure.

The liberty to challenge any decision at any stage under IBC is time consuming which stalls the process or delays the process; the legitimate intention to wind up is taken to tasks and increases the legal cost.

Since the power U/s 271(a) r/w 272 of the Companies Act, 2013 vests only with the tribunal to decide as to whether the winding up of the Company can be allowed or not the decision of the Creditors turns to be secondary, because the tribunal analyses that the fact based on “possession of the debtor” rather than the “creditor in control insolvency system”.

Findings

The manner of recourse chosen is determined by variables such as eligibility, solvency, the company’s asset-liability situation, and the level of judicial intervention, which varies depending on the circumstances and facts of each individual case.

However, the section 271(a) of the Companies Act, 2013 has more viability and consensus as, it serves to facilitate the orderly dissolution of companies while safeguarding the interests of stakeholders and ensuring compliance with legal and regulatory requirements further ensuring that the procedure is conducted in accordance with the law, with apt judicial intervention,

Whereas the insolvency resolution process U/s 10 IBC, 2016 can be complex and lengthy, involving various stakeholders such as creditors, debtors, resolution professionals, and adjudicating authorities. This complexity can lead to delays in resolving the insolvency, which might not be conducive to the interests of all parties involved as the scope is predilected towards financial creditors.

References:

[2] CP-307/MB/2021

[3] CP-340/MB/2021

[4] CP-399/MB/2021

[5] In the matter of M/s Essar Machine Works Private Limited CP/1334/2019

[6] In the matter of TicketGoose. Com India Private Limited CP(IB)/211(CHE)/2023

[7] Registrar of Companies

[8] IN THE NATIONAL COMPANY LAW TRIBUNAL NEW DELHI, COURT-III (IB)-596(ND)/2023

[10] Adjudicating Authority.

[11] (2021) ibclaw.in 17 NCLAT

[12] M/s Synew Steel Private Limited

[13] IA 453 of 2020

[14] (2023) ibclaw.in 894 NCLT

[15] (2023) ibclaw.in 551 NCLT

[16] (2023) ibclaw.in 537 NCLT

[17] (2023) ibclaw.in 514 NCLT

[19] IA(IBC)/316/KOB/2023 IN CP(IB)/29/KOB/2021, Mr. M. Suresh Kumar vs IDBI Bank Limited, decided on 13.10.2023